How to issue a Polish Invoice for Importing European Services?

An invoice is a settlement document that is used during international trade. Issued by a local seller to a foreign buyer with full information about the delivered goods. The document contains a list of goods, their quantity and the price at which they were delivered, the formal features of the goods (color, weight), delivery terms, information about the sender and recipient, their bank details.

Why are invoices needed? First of all, for crossing the customs border, protecting the interests of the seller and the buyer, determining the amount of customs duties, ensuring the settlement of the buyer with the seller (the goods are paid according to the invoice).

The invoice indicates the fact of the shipment of the goods and the obligation of the recipient of the goods to pay for the goods in accordance with the agreements clearly stated in the contract (except for situations with prepayment).

Invoice Forms

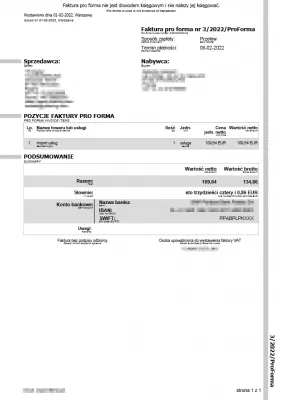

Invoices are divided into two forms - commercial invoice and proforma invoice. Although, in fact, it is one and the same document.

A commercial invoice is an invoice that the company must send to the buyer along with the shipped goods.

A pro forma invoice is a preliminary document sent by the seller in some cases. For example, if the amount of payment or the characteristics of the goods are not completely agreed. Or the contract provides for the transfer of an advance payment by the buyer. This type of invoice is filled in if it is impossible to determine the exact entire product before loading. In this case, a proforma invoice is received by customs, and after weighing the cargo, a commercial invoice is issued with accurate information and weight.

How to fill out invoices

An invoice in international trade is a strictly accountable document. Based on the information contained in it, the amount of customs duties is determined, VAT is charged, which the importer must pay.

Value added tax (VAT) - Polish Investment and Trade AgencyThe invoice is used as the main evidence in court with contractors and regulatory authorities. Therefore, the issuance of this document must be approached with all responsibility.

Usually the invoice is filled out on the letterhead of the enterprise. It is recommended to write it in electronic form, and duplicate it on paper.

The document must have the following information:

- Invoice number;

- Date of preparation;

- Name and details of the seller and buyer;

- Payment details;

- Details of the foreign economic transaction in accordance with which the delivery is carried out (optional);

- Terms of delivery according to Incoterms;

- Terms of payment;

- Name of goods, their price;

- The total value of the account;

- Currency;

- Rates and amount of tax;

- Loading location;

- The amount and grounds for granting discounts (subject to provision).

The item description should include the following items:

- Product Name;

- Numbers of export documents;

- Date of their compilation;

- Scope of the product (if the product has such characteristics);

- Serial numbers (if the product has such characteristics);

- Quantity of goods;

- The material from which the goods are made;

- Serial number and position number (if any);

- Type of packaging;

- Weight of goods;

- Price for one unit;

- Unit of measurement;

- Total amount.

Language, currency and details

The total amount is indicated in the currency specified in the supply contract. Sometimes the buyer pays for the goods in another currency. In this case, the invoice indicates at what rate and on what date the total amount will be transferred.

Information about the names of commodity items, cost and quantity of goods is filled in on the basis of the data under the contract. The document must contain the date of its compilation and the signature of the seller.

The corresponding column also specifies the terms of delivery in accordance with INCOTERMS-2010. This is a collection of generally accepted international rules, which is used when concluding sales contracts. The most popular classifications in the collection:

1. CFR (Cost and Freight)

The seller undertakes to deliver the goods on board the vessel. Freight and costs associated with the delivery of goods to the agreed port are paid by the seller, having concluded an agreement in advance.

2. FOB (Free on Board)

Cheapest EUR To PLN Exchange With No Hidden Fees

Did you know that you can easily open a multicurrency account on which you can hold many currencies, such as EUR and PLN among others, and convert your EUR to PLN or your PLN to EUR at anytime with a few clicks and some of the world’s lowest fees?

Free registration

The seller undertakes to deliver the goods on board the ship specified by the buyer to the port that was specified in the contract in advance. When the goods are on board the ship, the risks for damage or loss of the goods are transferred from the seller to the buyer.

3. CIF (Cost Insurance and Freight)

The seller undertakes to deliver the goods on board the ship. He also draws up an insurance contract that covers various risks for damage to the goods during transportation.

In the Terms of payment paragraph, the bank details are indicated: IBAN (international bank account number), name, legal address of the organization, address of the banking organization, its SWIFT code, correspondent account number, payment term.

The invoice is usually filled in in English.

How to send

The commercial invoice must be drawn up in six copies (original + five copies). The original is certified by the signature of the sender. One copy is invested in the parcel that must accompany the goods, the second goes along with the cargo and the bill of lading (usually in a special pocket attached to the cargo), two copies (one for each) are sent to the supplier and recipient of the goods, the carrier keeps two more samples .

Before sending, you need to carefully check the invoice, because it is forbidden to make changes to it after it has been signed. First of all, make sure that you have 1 original and 5 copies of the document, check the description of the content of the sent goods, the presence of the sender's signature.

To avoid problems at customs, experts advise making invoices on the same day the goods were sent. Otherwise, the money will have to wait much longer. To avoid delays in payments, draft invoices should be made. It is also necessary to agree in advance with the counterparty how he wants to receive the invoice - by e-mail or in paper form. It is also desirable to store all received and sent invoices. You should always remember that this is the main document when working with a counterparty.

Import and export of goods to the EU

Import of goods into the territory of the EU countries occurs by analogy with other countries. The EU border crossing country is considered the place of delivery and import VAT must be paid there. If the goods were previously in one of the customs regimes, such as a customs warehouse, a free trade zone, temporary import or external transit, then the country in which they exit these regimes will be recognized as the place of delivery.

The amount with which VAT must be paid includes the customs value of the goods, duties and taxes other than VAT itself. Also, the taxable amount may include the cost of commissions, packaging, insurance and transportation to the destination in the importing country. Discounts and discounts provided by the supplier to the buyer do not affect the taxable base.

Value added tax (VAT) - European CommissionThe amount of import tax is deductible if the importer is a VAT payer. If the importer is not a VAT payer, the import tax still has to be paid. At the same time, such a payer does not have the right to a tax credit, and the amount of VAT paid will be included in the price of goods during their further sale.

VAT - Business in Poland – Biznes.gov.plImport VAT is not paid in the following transactions:

- Import of goods not subject to VAT in the importing country;

- Supply of goods for personal consumption, the import of which is not of a commercial nature;

- Delivery of goods in the re-import mode;

- Import of goods in accordance with diplomatic and consular agreements, as well as goods exempt from payment of import duties;

- Imports of goods by international institutions within the limits set for such institutions.

The list of goods exempt from taxation is determined by the internal legislation of each country. The directive dictates the general principles for the application of VAT in the EU.

If a zero VAT rate is applied when exporting goods, then the counterparty is entitled to a refund or tax deduction. Documents confirming the application of the zero rate are issued when crossing the border at the checkpoints on the territory of the European Community, they must be kept.

VAT rate in percent by country

- Austria - 20%;

- Belgium - 21%;

- Bulgaria - 20%;

- UK - 20%;

- Hungary - 27%;

- Germany - 19%;

- Greece - 24%;

- Denmark - 25%;

- Ireland - 23%;

- Spain - 21%;

- Italy - 22%;

- Cyprus - 19%;

- Latvia - 21%;

- Lithuania - 21%;

- Luxembourg - 17%;

- Malta - 18%;

- Netherlands - 21%;

- Poland - 23%;

- Portugal - 23%;

- Romania - 19%;

- Slovakia - 20%;

- Slovenia - 22%;

- Finland - 24%;

- France - 20%;

- Croatia - 25%;

- Czech Republic - 21%;

- Sweden - 25%;

- Estonia - 20%.

Frequently Asked Questions

- What legal requirements must be met when issuing a Polish invoice for importing services from the EU?

- When issuing a Polish invoice for importing European services, it must comply with EU and Polish regulations, including details like the VAT ID, a description of the services, the date of supply, and the total amount in PLN. It's also important to apply the correct VAT rate and ensure all currency conversions are accurately represented.

Cheapest EUR To PLN Exchange With No Hidden Fees

Did you know that you can easily open a multicurrency account on which you can hold many currencies, such as EUR and PLN among others, and convert your EUR to PLN or your PLN to EUR at anytime with a few clicks and some of the world’s lowest fees?

Free registration