Revamp Your Savings: How Revolut Offers a 5% Annually Paid Daily Interest as a Smart Alternative to Life Insurance

- Revamp Your Savings: How Revolut Offers a 5% Annually Paid Daily Interest as a Smart Alternative to Life Insurance

- 1. Revolut's High-Interest Savings Account Explained:

- 2. Benefits Over Traditional Life Insurance:

- 3. Maximize Your Money: 5% Interest per annum paid daily Savings Account as Flexible Life Insurance Alternative:

- 4. Getting Started with Revolut:

- 5. Personal Finance Management with Revolut:

- Conclusion:

- Frequently Asked Questions

In the realm of personal finance, traditional savings methods and life insurance plans have long been the pillars of financial security. However, as the global financial landscape evolves, the quest for more innovative, flexible, and lucrative financial solutions becomes crucial, particularly for individuals engaged in EUR to PLN transactions. Enter Revolut, a fintech trailblazer, introducing a groundbreaking high-interest savings account that challenges conventional financial wisdom.

Revamp Your Savings: How Revolut Offers a 5% Annually Paid Daily Interest as a Smart Alternative to Life Insurance

1. Revolut's High-Interest Savings Account Explained:

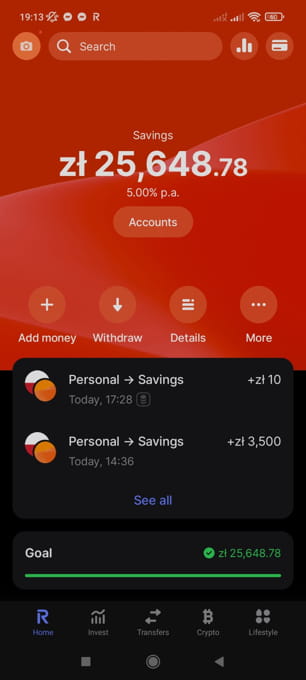

Imagine a savings account where your deposits not only sit safely but also grow at an impressive rate of 5% interest per annum, paid out daily. This is what Revolut offers with its 5% interest savings account, turning the traditional concept of savings on its head. Unlike regular savings accounts or life insurance policies, this approach offers a high degree of flexibility and immediate returns.

2. Benefits Over Traditional Life Insurance:

Traditional life insurance schemes are known for their rigidity and often, their indirect costs like agent commissions. Revolut’s savings account, in contrast, provides direct control over your funds with no hidden fees. The ability to deposit and withdraw at will, coupled with the daily interest payout, makes it a dynamic tool for both short-term and long-term financial planning, especially for those dealing with currency fluctuations between the Euro and the Polish Zloty.

3. Maximize Your Money: 5% Interest per annum paid daily Savings Account as Flexible Life Insurance Alternative:

This embedded video serves as a comprehensive guide, explaining in detail how Revolut’s savings account can significantly enhance your financial strategy. It offers practical insights into making your savings work harder for you.

4. Getting Started with Revolut:

Setting up an account with Revolut is straightforward and user-friendly. By following a few simple steps outlined in our guide, you can quickly start taking advantage of this innovative savings option. Remember, using our exclusive affiliate link to sign up for Revolut can offer you additional benefits.

5. Personal Finance Management with Revolut:

Cheapest EUR To PLN Exchange With No Hidden Fees

Did you know that you can easily open a multicurrency account on which you can hold many currencies, such as EUR and PLN among others, and convert your EUR to PLN or your PLN to EUR at anytime with a few clicks and some of the world’s lowest fees?

Free registration

Beyond the high-interest savings account, Revolut offers a suite of personal finance management tools. These include real-time budgeting solutions, instant spending notifications, and advantageous EUR to PLN exchange rates. Such features make Revolut an invaluable asset for savvy financial management in today’s global economy.

Conclusion:

The Revolut high-interest savings account represents more than just an alternative to traditional life insurance; it's a paradigm shift in personal finance. Offering flexibility, high returns, and user-friendly features, it empowers you to take control of your financial future in a way that traditional methods cannot match.

Embrace the future of savings with Revolut. Sign up today using our affiliate link and start transforming your financial strategy. Don’t forget to share this life-changing tool with your network!

Frequently Asked Questions

- How does a 5% daily interest savings account serve as a flexible alternative to traditional life insurance?

- A 5% daily interest savings account can accumulate funds rapidly, providing a financial cushion that can be used as an alternative to traditional life insurance. Unlike life insurance, it offers flexibility in terms of withdrawals and usage, allowing account holders to access funds when needed for various purposes.

Michel Pinson is a Travel enthusiast and Content Creator. Merging passion for education and exploration, he iscommitted to sharing knowledge and inspiring others through captivating educational content. Bringing the world closer together by empowering individuals with global expertise and a sense of wanderlust.

Cheapest EUR To PLN Exchange With No Hidden Fees

Did you know that you can easily open a multicurrency account on which you can hold many currencies, such as EUR and PLN among others, and convert your EUR to PLN or your PLN to EUR at anytime with a few clicks and some of the world’s lowest fees?

Free registration